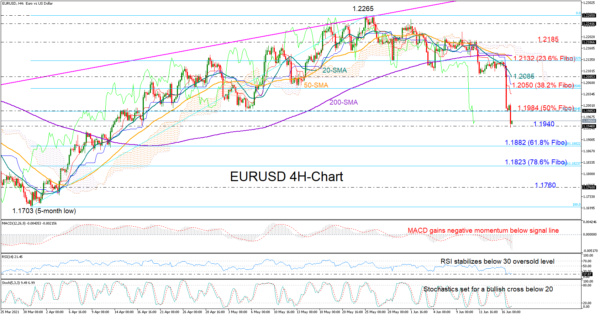

EURUSD was one of the biggest victims of the hawkish FOMC policy announcement, with the price collapsing by more than 1.30% below May’s lows in the aftermath and extending its freefall lower to 1.1940 on Friday.

An upside reversal would not be a big surprise in the near term in the four-hour chart given the RSI’s deep downfall inside the oversold area. The Stochastics also look set for a bullish cross in the oversold territory, though neither of those indicators have showed a convincing upturn yet. Hence, the basic scenario is for the sellers to dominate in the short term.

Nevertheless, a decisive close below the 1.1940 restrictive area is required to pressure the price towards the 61.8% Fibonacci retracement of the 1.1703 – 1.2265 upleg at 1.1882. Slightly lower, the 78.6% Fibonacci of 1.1823 may also attract attention before the way clears towards the 1.1760 -1.1703 zone.

Alternatively, the pair will need a solid foundation to recover the FOMC damage. The 50% and 38.2% Fibonacci levels could adopt a resistance role at 1.1984 and 1.2050 respectively, while not far above, the 20-period simple moving average (SMA) could negate any bullish movements towards the crucial barrier around the 23.6% Fibonacci of 1.2132. Note that the 50- and 200-period SMAs are also in the neighborhood.

Summarizing, EURUSD is looking bearish but oversold in the short-term picture. A sustainable move below 1.1940 is expected to trigger the next bearish round.