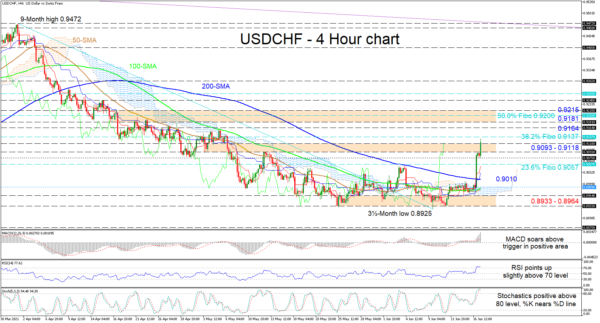

USDCHF is extending yesterday’s gains, which catapulted the price up from around 0.8990, after recoiling a tad off 0.9093 – the lower band of the resistance region in hand. The initial thrust of the rally overtook the 200-period simple moving average (SMA) and the 0.9057 level, which happens to be the 23.6% Fibonacci retracement of the down leg from 0.9472 until 0.8925. The upturn in the 50- and 100-period SMAs is positive, while the bullish Ichimoku lines are fortifying upward forces.

The short-term oscillators are conveying that upside momentum is growing. The MACD is strengthening above its red trigger line, while the RSI is improving in overbought territory. The stochastic oscillator’s lines are above the 80 level and signs of waning in the positive impetus have yet to be confirmed. Traders would be wise to keep their eye on a positive overlap of the 200-period SMA by the 50- and 100-period averages, which would reinforce the climb even further.

If buyers manage to close above the limiting section of 0.9093-0.9118, which had halted the price surge that occurred yesterday evening, upcoming resistance could then arise from the 38.2% Fibo of 0.9137 ahead of the 0.9164 barrier. Successfully piloting past these obstacles, bullish efforts could now be countered by a nearby buffer zone of 0.9181-0.9215, which also encapsulates the 50.0% Fibo.

In the event price retreats below the 0.9093-0.9118 area, initial support could come from the 0.9075 low ahead of the 23.6% Fibo of 0.9057. Diving from here, friction from the Ichimoku lines may form before sellers target the 200-period SMA at 0.9010 and the cloud’s upper surface at 0.8989. Additional dwindling in the pair could then meet the 3-month foundation of 0.8933-0.8964.

Summarizing, USDCHF newfound bullish charge may remain intact if the price closes above the 0.9093-0.9118 boundary. That said, a dip below 0.9075 could signify that the positive move may not be sustainable.