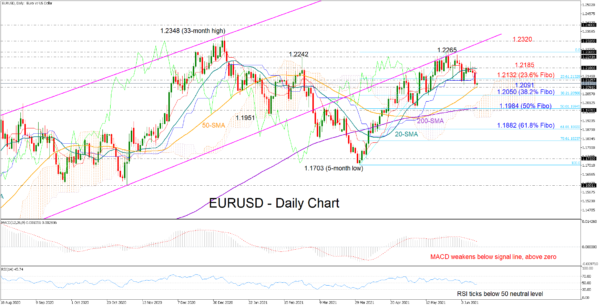

EURUSD could not close above the 20-day simple moving average (SMA) and the 1.2185 level despite last week’s attempt, with the price collapsing to meet support near the 50-day SMA at 1.2091 in the aftermath.

Trend signals remain encouraging as the positive SMA crosses are still intact. Yet, as regards the price momentum, the technical indicators are raising a warning flag. The RSI has inched below its 50 neutral level, the MACD continues to decelerate below its red signal line, and the Ichimoku lines (Tenkan-sen & Kijun-sen) are set to mark a bearish intersection again since the last one three months ago.

Should sellers claim the 50-day SMA, the 38.2% Fibonacci retracement of April’s upleg and the surface of the cloud could immediately come to the rescue around 1.2050. The 200-day SMA and the 50% Fibonacci of 1.1984 could be the next turning point if the sell-off exacerbates, likely preventing another steep downfall towards the 61.8% Fibonacci of 1.1882, and therefore a trend deterioration below the previous low.

On the upside, the nearby 23.6% Fibonacci of 1.2132 could delay any move towards the 20-day SMA and the 1.2185 barrier. In the event the bulls dominate above the latter, all attention will switch back to the tough 1.2242 resistance region, a break of which will clear the way towards the restrictive line and the closing price of 1.2320 from January 7.

In brief, EURUSD is expected to remain fragile in the short term, likely trading with weak momentum unless the 50-day SMA manages to push the price back above 1.2185.