Key Highlights

- EUR/USD failed to surpass 1.2200 and started a downside correction.

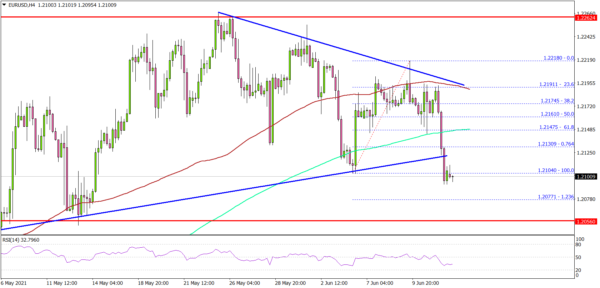

- A major bearish trend line is forming with resistance near 1.2190 on the 4-hours chart.

- GBP/USD also struggled to surpass 1.4200 and corrected lower.

- USD/JPY is still trading above the main 109.00 support region.

EUR/USD Technical Analysis

The Euro made a couple of attempts to gain strength above 1.2200 against the US Dollar. However, EUR/USD failed to continue higher and started a downside correction.

Looking at the 4-hours chart, the pair traded as high as 1.2218 and recently started a fresh decline. There was a clear break below the 1.2180 support level and the 100 simple moving average (red, 4-hours).

The pair even declined below the 1.2150 support and the 200 simple moving average (green, 4-hours). It tested the last swing low near 1.2100.

If there are more losses, the pair could test the 1.2050 support. The next key support is near the 1.2035 level. It is close to the 1.618 Fib extension level of the upward move from the 1.2104 swing low to 1.2218 high.

Any more losses could lead the pair towards the 1.2000 support zone. On the upside, an initial resistance is near the 1.2150 level and the 200 SMA.

The main resistance is near the 1.2190 level and the 100 SMA. There is also a major bearish trend line forming with resistance near 1.2190 on the same chart. A clear break above the 1.2190 and 1.2200 levels could open the doors for a test of the 1.2250 resistance.

Besides, GBP/USD also failed to gain pace above the 1.4200 resistance and it could decline further if there is a break below the 1.4100 support.

Economic Releases

- Euro Zone Industrial Production for April 2021 (MoM) – Forecast +0.4%, versus +0.1% previous.