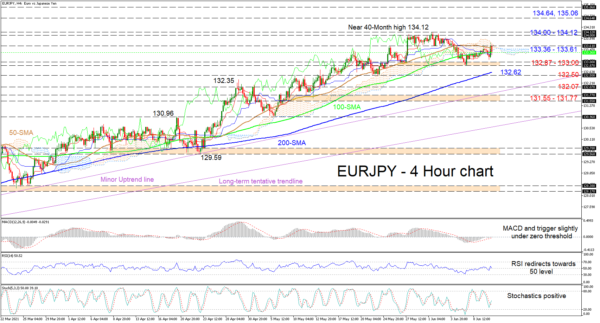

EURJPY is attempting to propel above the Ichimoku cloud after adopting a more sideways trajectory around the 133.36-133.61 zone, following its failed struggle to decisively navigate beyond the 134.00 handle. The shallower incline of the 50- and 100-period simple moving averages (SMAs) is endorsing a pause in price improvements, while the rising 200-period SMA is defending the uptrend.

The Ichimoku lines are ever so slightly skewed to the upside, while the short-term oscillators are conveying mixed signals in directional momentum. The MACD and its red trigger line are a tad beneath the zero threshold, while the RSI has recoiled towards the 50 mark. Alternatively, the stochastic oscillator is sustaining a positive charge, promoting the bullish price action.

If buyers manage to nudge the price above the 133.61 barrier with a close north of the Ichimoku cloud, they could then target the resistance band of 134.00-134.12. Should this border, which also involves the near 40-month peak, fail to keep advances at bay, the bulls may drive the price upwards to test the 134.64 frontier and the 135.06 high.

Otherwise, if sellers thrust the price beneath the 100-period SMA at 133.36, the pair could quickly target the support base of 132.87-133.00. Another leg down may then challenge the 200-period SMA at 132.62 and the nearby trough of 132.50. A deeper retracement could confront the minor uptrend line – pulled from 125.08 – and the 132.07 barrier, while growing negative pressures could sink the pair towards the support region of 131.55-131.77.

Summarizing, EURJPY is exhibiting forces that are lacking the capabilities to propel the price higher. As things currently stand, the pair retains its neutral-to-bullish demeanour.