The Australian dollar remains within a narrow range for the third straight day after last week’s sharp fall was quickly reversed, keeping the price at familiar levels.

Positive signals from lower US yields were offset by a dovish stance from RBA, with expectations that inflation would remain subdued and keep loose monetary policy in play for a prolonged period of time.

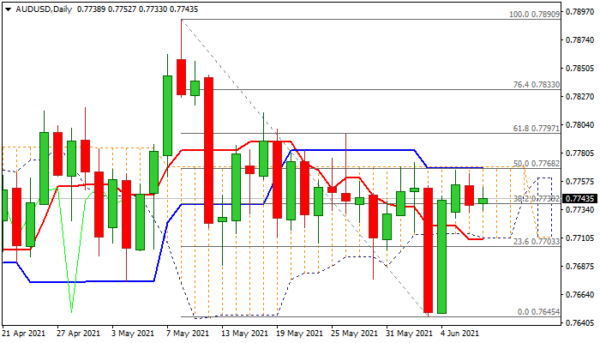

Near-term action is moving within daily cloud (spanned between 0.7710 and 0.7768) with the cloud base being reinforced by daily Tenkan-sen and the upper boundary -cloud top – strengthened by daily Kijun-sen.

Break of either side would provide fresh direction signal, but rising negative momentum on daily chart and overbought stochastic suggest that near-term action remains bearishly aligned.

Investors focus on Thursday’s ECB policy meeting and US inflation data which could give more hints about interest rate expectations and generate fresh signals.

Res: 0.7752; 0.7768; 0.7797; 0.7813.

Sup: 0.7730; 0.7710; 0.7677; 0.7645.