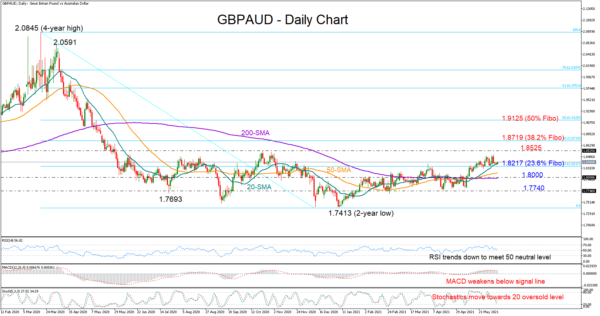

GBPAUD continues to trade within a broad range, but the slow pace of higher highs and higher lows from the two-year low of 1.7413 registered in January, and the recent bullish intersection between the simple moving averages (SMAs) could be an encouraging sign of trend improvement.

As regards the price momentum, the technical oscillators keep the short-term bias on the bearish side as the RSI is trending downwards to meet its 50 neutral level, and the MACD is losing strength below its red signal line. The Stochastics hold a negative trajectory as well, favoring additional downside corrections in the market.

Nevertheless, in the very short-term picture, the price could debunk the daunting signals coming from the technical oscillators if it finally manages to bounce on the 20-day SMA at 1.8253 and rally above the range’s upper boundary of 1.8525. Beyond that ceiling, the bulls could gear up to test the 38.2% Fibonacci retracement of the 2020 sell-off at 1.8719, while higher, the next battle could develop around the 50% Fibonacci of 1.9125.

Otherwise, should the 20-day SMA prove to be fragile, letting the pair slip below the 23.6% Fibonacci of 1.8217 too, traders could look for support near the 1.8000 round-level, where the 200-day SMA resides as well. If sellers persist, the spotlight will turn to the crucial floor of 1.7740, a break of which may pressure the price straight to the two-year low of 1.7413.

In brief, GBPAUD continues to follow a sideways path in the big picture, though there is a ray of optimism that a bullish trend reversal could be in progress and a decisive close above 1.8525 is required to confirm that.