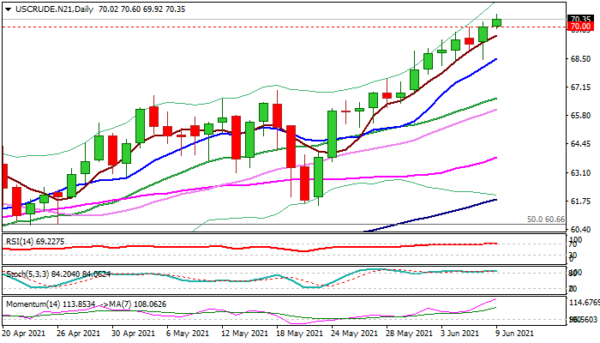

WTI oil price rose above $70 per barrel for the first time since mid-October 2018, lifted by strong demand in western economies and fading prospects for return of Iranian supplies after top US diplomat said that sanctions against Tehran were unlikely to be lifted, while continuous drop in crude inventories and start of the summer driving season in the US, add to positive oil sentiment.

Fresh bulls look for confirmation on close above $70 to resume rally towards initial targets at $72.38 (Fibo 100% expansion of the wave C of five-wave cycle from $6.52) and $73.44 (Fibo 61.8% of $114.80/$6.52) with possibility of extension towards $76.88 (2018 high), on stronger acceleration higher.

Technical studies on larger timeframes remain in full bullish setup and support the action but overbought conditions warn of correction.

Dips are expected to provide better opportunities to join bullish market and should find solid supports at $68/$67 zone.

Res: 70.60, 71.00, 72.00, 72.38.

Sup: 70.00, 69.57, 68.38, 67.95.