The Euro ticked lower in early Monday following Friday’s jump after a second consecutive month of weaker than expected US NFP data failed to inspire stronger dollar rally on fading expectations that accelerating US economic recovery would prompt the Fed to start tapering policy support earlier than expected. US labor data improved Euro’s sentiment, but the signal was insufficient to spark a stronger advance, suggesting that the single currency would remain in a range and awaiting for fresh catalyst, with ECB policy decision and US inflation report is in focus this week.

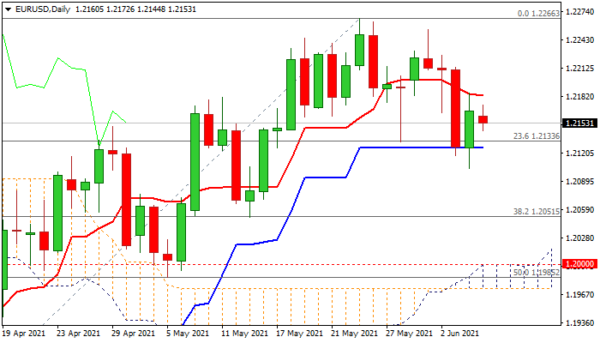

Near-term action is entrenched between daily Tenkan-sen (1.2183) and daily Kijun-sen (1.2126), with a break of either boundary to generate an initial direction signal.

Negative signal on the break of Kijun-sen would look for confirmation on acceleration through 1.2051 Fibo support and 100DMA (1.2040), while verification of bullish scenario would require sustained break above 1.2200 resistance zone.

Daily technical studies are bearishly aligned (rising negative momentum / 5/10/20 DMA’s in bearish setup), keeping immediate risk skewed lower.

Res: 1.2172, 1.2183, 1.2192, 1.2214.

Sup: 1.2143, 1.2126, 1.2103, 1.2051.