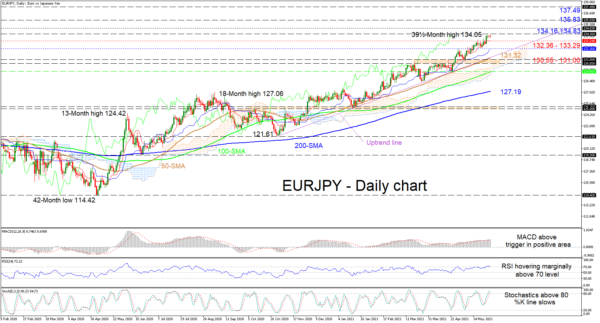

EURJPY has hiked towards a 39½-month high marginally overshooting the 134.00 handle. Although the pair’s immediate bullish drive has vanished just short of the resistance barrier of 134.16, the ascending simple moving averages (SMAs) are bullet proofing the uptrend.

Despite the flattening of the red Tenkan-sen line, the Ichimoku lines are establishing firm defences to counter price pullbacks. The short-term oscillators are also favouring the upside as positive momentum currently possesses a marginal advantage. The MACD is sticking above its red trigger line, while the static RSI is persevering north of the 70 level. The stochastic oscillator’s %K line is stalling in overbought territory but has yet to confirm negative price action as the frontrunner.

To the upside, immediate resistance could emanate from the 134.16 high and the nearby resistance barrier of 134.83, both identified in early February 2018. Surpassing this buffer zone between the aforementioned levels, the price may then thrust for the 135.83 high, while any further intensifying in buying interest could then propel the price to challenge the 137.49 peak of February 2018.

Otherwise, if sellers take the lead, initial support could develop between the Ichimoku lines from 133.29 until 132.36, to counter a price pullback. Next, the uptrend line – pulled from the 121.61 trough – together with the 50-day SMA, currently at 131.32, could provide the next deterrents to further retracements in the price. However, failing to dismiss negative developments, traders’ focus may then turn towards the cloud and the 130.55-131.00 support section.

Summarizing, for negative pressures to start to weigh on EURJPY’s bullish picture, the price would need to break below the ascending line and the 131.00 trough.