Key Highlights

- USD/JPY started a strong increase from the 108.60 support zone.

- It broke a major bearish trend line with resistance near 108.90 on the 4-hours chart.

- The US GDP grew 6.4% in Q1 2021 (Prelim), similar to the last reading.

- EUR/USD corrected lower from 1.2260, GBP/USD remained well bid above 1.4100.

USD/JPY Technical Analysis

The US Dollar started a strong increase from the 108.57 swing low against the Japanese Yen. USD/JPY broke many hurdles near 109.00 to move into a positive zone.

Looking at the 4-hours chart, the pair settled nicely above the 109.20 level. There was a clear break above a major bearish trend line with resistance near 108.90.

It even surged above the 61.8% Fib retracement level of the last key decline from the 109.78 high to 108.57 low. The pair settled above the 109.20, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

It seems like the pair might continue to rise above the 110.00 resistance level. The next major resistance on the upside is near the 110.50 level.

If there is a downside correction, the previous resistance near 109.20 is likely to act as a support. The next major support is near 109.00 level and the 100 simple moving average (red, 4-hours).

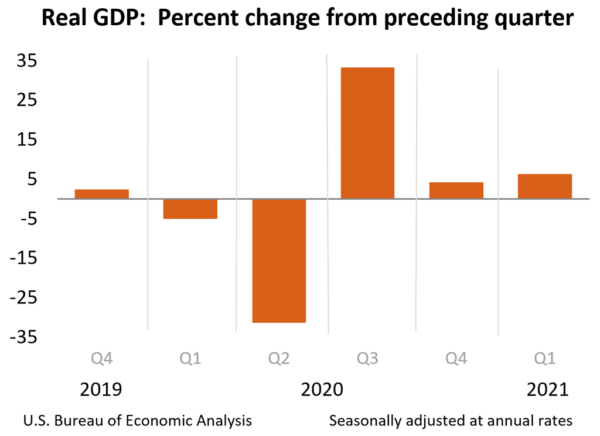

Fundamentally, the US Gross Domestic Product report for Q1 2021 was released yesterday by the US Bureau of Economic Analysis. The market was looking for an increase of 6.5%.

The actual result was lower than the forecast, as the US GDP grew 6.4% in Q1 2021 (Prelim), similar to the last reading.

The report added:

Real gross domestic product (GDP) increased at an annual rate of 6.4 percent in the first quarter of 2021, reflecting the continued economic recovery, reopening of establishments, and continued government response related to the COVID-19 pandemic.

Overall, USD/JPY could continue to rise above the 110.00 level. Looking at EUR/USD, the pair corrected lower and tested the 1.2180 level. GBP/USD remained strong above the 1.4100 support zone.

Economic Releases

- US Personal Income for April 2021 (MoM) – Forecast -14.1%, versus +21.1% previous.

- Chicago Purchasing Manager’s Index for May 2021 – Forecast 68.0, versus 72.1 previous.

- Michigan Consumer Sentiment Index for May 2021 – Forecast 82.9, versus 82.8 previous.