Key Highlights

- EUR/USD gained pace above the 1.2000 and 1.2050 resistance levels.

- A major bullish trend line is forming with support near 1.2045 on the 4-hours chart.

- GBP/USD traded close to the 1.3820 support before correcting higher.

- The German IFO Business Climate Index could increase from 96.6 to 97.7 in April 2021.

EUR/USD Technical Analysis

The Euro started a major increase above the 1.1950 resistance against the US Dollar. EUR/USD even broke the 1.2000 hurdle to move into a positive zone.

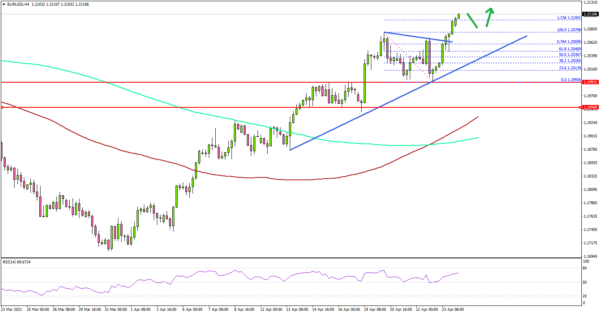

Looking at the 4-hours chart, the pair gained pace above the 1.2050 level. The pair is now trading well above the 1.2000 level, the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours).

There was a minor dip from the 1.2079 high, but the pair remained well bid near 1.2000. The last swing low was formed near 1.1993 before the pair started a fresh increase.

There was a clear break above the 1.2079 high. The pair even tested the 1.236 Fib extension level of the downward move from the 1.2079 high to 1.1993 low.

It seems like the pair might continue to rise above the 1.2120 resistance. The next major resistance is near 1.2150, above which the pair could rise towards the 1.2200 level.

On the downside, there is a major bullish trend line forming with support near 1.2045 on the same chart. Any more losses might call for a test of the main 1.2000 support.

Overall, EUR/USD is likely to continue higher as long as it is above 1.2000. Conversely, GBP/USD extended its decline towards the 1.3820 support zone and the 100 simple moving average (red, 4-hours).

Economic Releases

- German IFO Business Climate Index for April 2021 – Forecast 97.7, versus 96.6 previous.

- German IFO Current Assessment Index for April 2021 – Forecast 94.5, versus 93.0 previous.

- US Durable Goods Orders for March 2021 – Forecast +2.5% versus -1.2% previous.

- US Nondefense Capital Goods Orders Excluding Aircraft for March 2021 – Forecast +1.1% versus -0.9% previous.