Key Highlights

- AUD/USD is facing hurdles near the 0.7675 and 0.7700 levels.

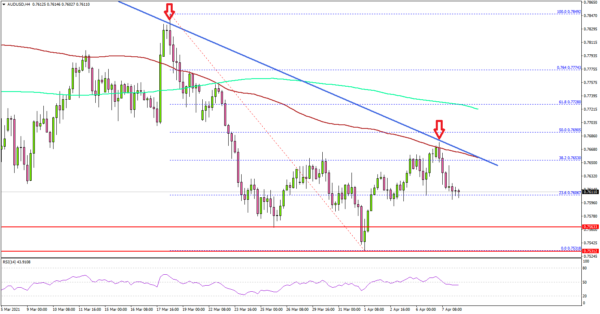

- A major bearish trend line is forming with resistance near 0.7660 on the 4-hours chart.

- EUR/USD recovered above 1.1850, while GBP/USD declined sharply from 1.3900.

- The US Initial Jobless Claims in the week ending April 03, 2021 could decline from 719K to 680K.

AUD/USD Technical Analysis

After trading as low as 0.7531, the Aussie Dollar started a fresh increase. AUD/USD recovered above 0.7600, but it is likely to face a strong selling interest near 0.7700.

Looking at the 4-hours chart, the pair recovered above 0.7600 and 0.7620. There was also a break above the 23.6% Fib retracement level of the downward move from the 0.7849 high to 0.7531 low.

However, the pair faced resistance near the 0.7670 level and the 100 simple moving average (red, 4-hours). There is also a major bearish trend line forming with resistance near 0.7660 on the same chart.

The next key resistance is near the 0.7690 level. It is close to the 50% Fib retracement level of the downward move from the 0.7849 high to 0.7531 low. A successful close above the trend line and 0.7700 could open the doors for a steady increase.

If not, there is a risk of a fresh decline towards the 0.7580 level. The next key support is near 0.7550, below which the pair could even clear the 0.7531 low.

Looking at EUR/USD, the pair cleared the 1.1850 resistance and it is now facing resistance near 1.1900. Besides, GBP/USD was rejected near 1.3900 and it declined sharply.

Economic Releases

- UK Construction PMI for March 2021 – Forecast 54.6, versus 53.3 previous.

- US Initial Jobless Claims – Forecast 680K, versus 719K previous.