Pound is turning south since last week BOE meeting when they said that current policy is appropriate, and some speculations indicate that they may not raise rates untill 2023. And then you also have vaccine supply issues which puts downward pressure on cable, while at the same time we see higher US yeilds making dollar strong.

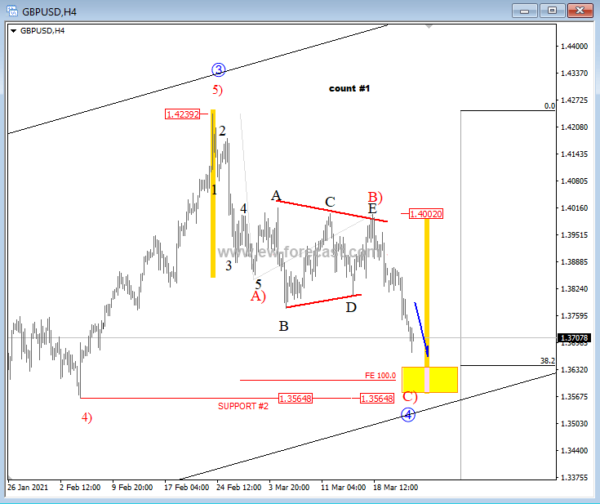

From an Elliott Wave perspective cable was expected to come down as we recognized a triangle pattern in wave B. It’s a continuation pattern that caused a new leg down, currently with a sharp and even accelerating drop into wave C). This leg can be headed to 1.3560/1.36 area while pair trades below 1.3880, especially if we cosnider that even latest strong PMI data cannot cause much of a recovery when looking at intraday price action. As such I think wave C) can stay in the cards for now, but it may again become very interesting for a new turn-around once a projected support is reached. Keep in mind that that whole drop from 1.4240 is still in three waves, thus it can be corrective wave 4 of a higher degree. But as always for any new change in trend we will have to wait on a five wave rise.