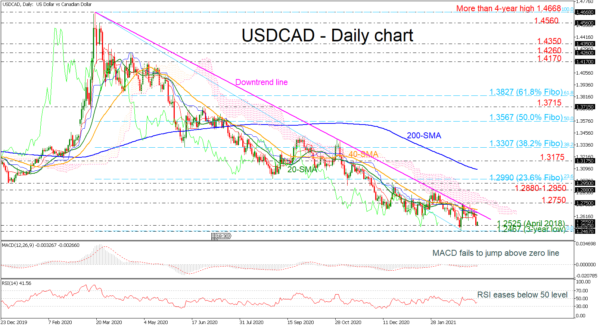

USDCAD is heading marginally north after the slip to the 1.2525 support level, however, the pullback off the descending trend line in the previous sessions signals a strong negative momentum in the broader outlook.

From the technical view, the MACD oscillator is suggesting a flattening movement as it stands slightly below its zero and trigger lines, however, the RSI is pointing up in the negative territory. The Ichimoku lines are showing a neutral-to-bearish bias in the short-term.

Further losses could take the bears towards the immediate trough created in April 2018 at 1.2525 before tumbling to the three-year low of 1.2467. If selling interest intensifies, traders could have eye for the 1.2250 barrier, being the low from January 2018.

In the positive scenario, any advances above the falling trend line could hit the 1.2750 hurdle and the lower surface of the Ichimoku cloud. Above that, the levels between 1.2880-1.2950 could halt bullish movements, before testing the 23.6% Fibonacci retracement level of the down leg from 1.4668 to 1.2467 at 1.2990. More gains could lead the price until the powerful 200-day SMA currently at 1.3090.

In conclusion, USDCAD has been in a bearish tendency over the last year, and only a significant climb above the 200-day SMA may switch this outlook to neutral.