WTI oil eases in European trading on Thursday following previous day’s bounce that sidelined fresh bears on pullback from new multi-month high at $63.79.

Oil prices remained mainly unaffected by a record surge in US crude inventories of more than 21 million barrels, due to extremely bad weather in Texas that resulted in refining plunging to a record low, as gasoline stocks fell by the most in 30 years.

Today’s OPEC+ group meeting is in focus as the cartel is considering rolling over production cuts into April, due to fragile nature of oil demand recovery as the coronavirus crisis continues, although market expected the group to ease production cuts by about 500,000 barrels per day from April and for Saudi Arabia to end its voluntary output cut for additional one million barrels per day.

The oil price has recovered significantly from record lows hit during the crisis and returned to pre-pandemic level, signaling that oil market has tightened, however fears that demand recovery can stall, due to worsening situation on new wave of coronavirus that kept on tight restrictions in the number of countries.

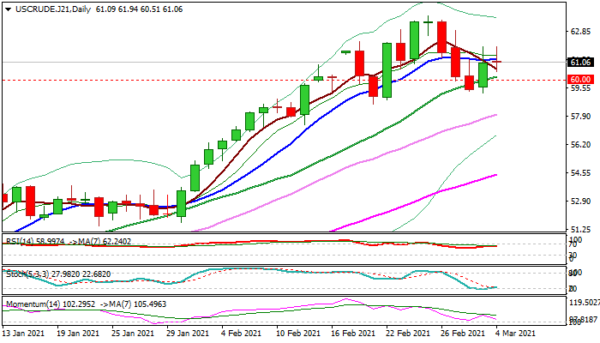

Technical studies continue to warn of further easing of oil prices, as daily techs continue to lose positive momentum and weeklies signal that larger bulls are running out of steam.

Broken psychological $60 barrier now marks significant support, with extended dips to find ground above rising 10DMA ($55.55) and keep bulls intact.

Conversely, break here and through more significant 200DMA ($53.47) would signal deeper correction and put bulls on hold.

Res: 61.97, 62.89, 63.54, 63.79.

Sup: 60.28, 60.00, 58.57, 55.55.