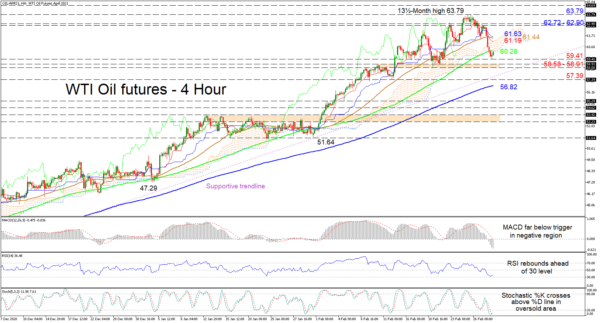

WTI oil futures’ recent bounce at 59.41 is tackling the curbing 100-period simple moving average (SMA) at 60.28, coupled with the Ichimoku cloud’s lower frontier. The SMAs are preserving the pair’s bullish bias in spite of the diminished upward slopes of the 50- and 100-period SMAs.

The bearish tone of the Ichimoku lines is stalling suggesting a marginal pickup in positive price action, while the short-term oscillators are transmitting conflicting signals in directional momentum. The upturn of the RSI prior to reaching the 30 level and the bullish crossover of the Stochastic %K line, in oversold territory, are endorsing a pickup in positive sentiment. However, the %K line has yet to push above the 20 level, while the MACD is plunging in bearish regions below its red trigger line. Therefore, the retracement may still have some fuel in the tank.

To the upside, immediate resistance may commence from the capping 100-period SMA at 60.28, in-line with the cloud’s lower band. If buyers manage to step over this obstacle, the next resistance zone could develop between the red Tenkan-sen line at 61.19 until the blue Kijun-sen line at 61.63 – an area surrounding the 50-period SMA at 61.44. Triumphing over these barriers, the bulls may target the resistance belt of 62.72-62.90 keeping in the corner of their eye the 13½-month peak.

If selling interest increases, the first downside deterrent comes at the nearby low of 59.41 ahead of a key support section of 58.58-58.91. Diving past this boundary, the price may challenge a supportive trend line drawn from the low of 34.02, identified in November 2020. Should the bears break below this, the 57.39 trough could draw traders’ attention ahead of the 200-period SMA, currently at 56.82.

Summarizing, should oil’s enduring bearish pressures manage to sink the price below the supportive trend line and the 57.39 trough, its predominant bullish bias could start to destabilise.