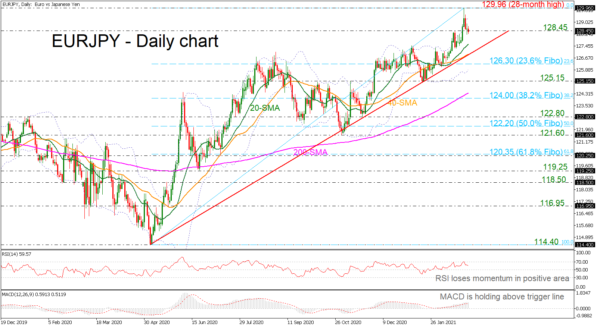

EURJPY is retreating over the last days from the spike that sent the market to the 28-month high of 129.96. The RSI is confirming the recent view and is moving downwards in the positive territory, while the MACD is still standing above its trigger line. In trend indicators, the 20- and 40-day simple moving averages (SMAs) are endorsing the broader bullish outlook.

In case that the price remains above the 128.45 support, the price could move until the multi-month peak of 129.96 again. Steeper increases could move the market towards the 133.20 resistance, registered in September 2018.

Alternatively, a continuation of the downside correction could find immediate support at the 20-day SMA currently at 127.60 ahead of the long-term ascending trend line and the 40-day SMA at 126.90. If the bears continue to sell the pair, support could come from the 23.6% Fibonacci retracement level of the up leg from 114.40 to 129.96 at 126.30. Below that, the lower Bollinger band around 126.00 could halt bearish movements.

Briefly, EURJPY has been in a strong upside tendency since May and if there is a plunge below the uptrend line, that could switch this view to neutral.