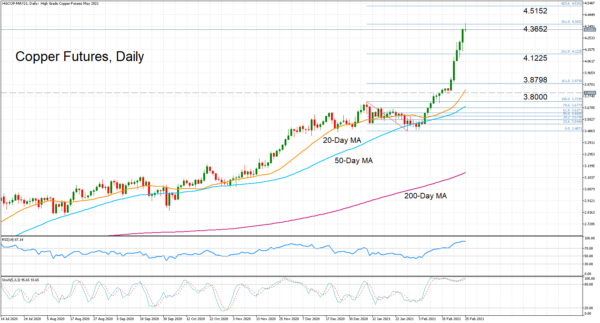

Copper futures hit another more than nine-year high on Thursday, as the bullish momentum that’s been gathering pace since the beginning of February shows no sign of abating in the very near term. The price is increasing its distance above the moving averages (MA), which are all sloping upwards and positively aligned.

However, momentum indicators are flashing red, with both the RSI and stochastic oscillator rooted firmly in overbought territory. Yet, the RSI continues to steadily edge higher, while the %K of the stochastics recently crossed back above the %D line, suggesting there is no immediate danger of a sharp downside correction. But given the heavily overstretched conditions, it may only be a matter of time before the latest upswing loses steam.

Should the rally falter, prices may initially settle near the 261.8% Fibonacci extension of the January downtrend at 4.1225. Lower down, the 161.8% Fibonacci extension of 3.8798 could halt a steeper decline before prices reach the 20-day MA, currently at 3.8268.

However, should copper extend its bullish run, it would first have to overcome the immediate barrier around the 361.8% Fibonacci of 4.3652. Successfully clearing this hurdle would turn attention to the 423.6% Fibonacci of 4.5152. Beyond that point, the psychologically important 5.0 level could become the next key target.

To sum up, while the latest uptrend could still have enough fuel left to cover several more miles, the risk of a correction is high. But as long as prices hold above the 3.80 area, which contains the 20-day MA, the short-term bullish picture should not be compromised.