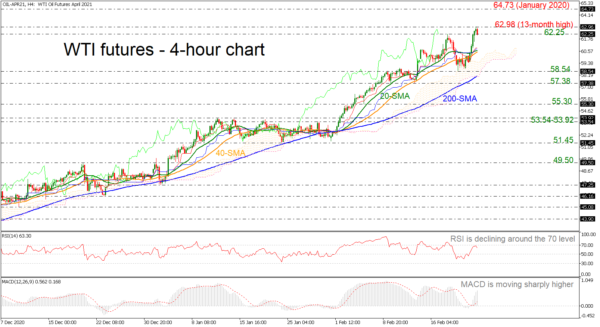

WTI crude oil futures have advanced considerably touching a 13-month high of 62.98 before moving marginally lower from this peak. The negatively aligned Tenkan- and Kijun-sen lines serve as a testament to the negative short-term momentum that is in place. The RSI and the MACD indicators are signaling a potentially overbought market; a near-term reversal should thus not be ruled out.

Immediate support may take place around the 62.25 support, while the 20- and 40-period simple moving averages (SMAs) around 60.50 could provide additional support in case of steeper losses. More downside pressure could hit the 58.54 barrier ahead of the 200-period SMA at 58.10.

On the other hand, a move to the upside may meet resistance around the multi-month high of 62.98. An even stronger bullish movement could take the market until the 64.73 barrier, registered in January 2020.

The medium- and long-term picture is looking predominantly bullish with price action taking place above the 200-period SMA, though caution is warranted in the near term as there are signs of an overbought market.