Key Highlights

- GBP/USD extended its rally above the 1.4000 resistance.

- A key support is forming near 1.3950 on the 4-hours chart.

- EUR/USD is showing positive signs, but it must gain strength above 1.2200.

- The UK Claimant Count could change 35K in Jan 2021, up from the last 7K.

GBP/USD Technical Analysis

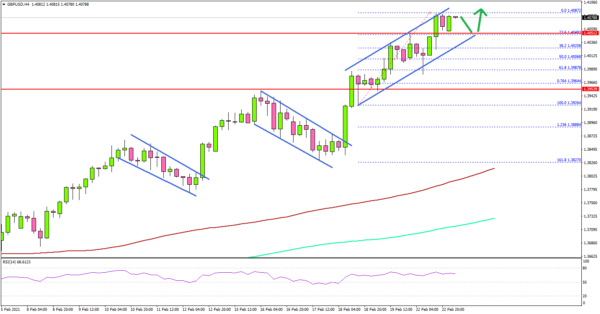

There was a steady increase in the British Pound value above 1.3900 against the US Dollar. GBP/USD even cleared a couple of important hurdles near 1.3950 and 1.4000.

Looking at the 4-hours chart, the pair cleared two bullish continuation patterns near 1.3800 and 1.3850 to move into a positive zone. The pair settled nicely above 1.4000, the 100 simple moving average (red, 4-hours), and the 200 simple moving average (green, 4-hours).

A new 3-year high was formed near 1.4087 and the pair is currently consolidating gains. On the downside, the first key support is near the 1.4050 level. It is close to the 23.6% Fib retracement level of the upward move from the 1.3926 swing low to 1.4087 high.

The main support is now forming near the 1.3950 level (the previous breakout zone). Any more losses might lead the pair towards the 1.3880 support.

On the upside, the pair could rise further above the 1.4100 level. However, the bulls are likely to face a strong resistance near 1.4200 (as discussed using the monthly chart).

Looking at EUR/USD could gain momentum if it settles above 1.2175 and then gains pace above 1.2200. Besides, there were bullish moves in AUD/USD and NZD/USD above 0.7800 and 0.7250 respectively.

Economic Releases

- UK Claimant Count Change Jan 2021 – Forecast 35K, versus 7K previous.

- UK ILO Unemployment Rate Dec 2021 (3M) – Forecast 5.1%, versus 5.0% previous.

- Euro Zone CPI Jan 2021 (YoY) – Forecast +0.9%, versus +0.9% previous.

- Euro Zone CPI Jan 2021 (MoM) – Forecast +0.2%, versus +0.3% previous.

- Fed’s Chair Powell testifies.