Key Highlights

- EUR/USD started a fresh increase after testing the 1.2020 zone.

- A connecting bullish trend line is forming with support near 1.2060 on the 4-hours chart.

- GBP/USD rallied further and it cleared the 1.4000 resistance.

- The German IFO Business Climate Index could increase from 90.1 to 90.5 in Feb 2021.

EUR/USD Technical Analysis

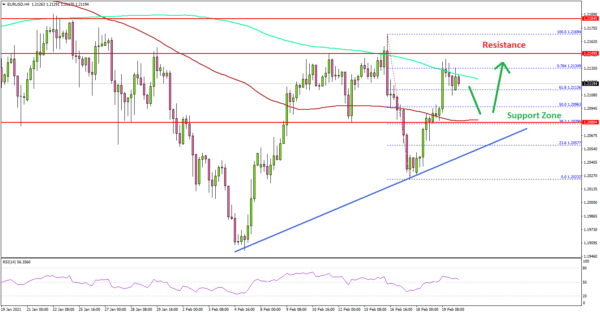

After a short-term downside correction, the Euro found support near 1.2020 against the US Dollar. EUR/USD started a fresh increase above 1.2050, but it is facing a strong resistance.

Looking at the 4-hours chart, the pair recovered nicely above 1.2050 and the 100 simple moving average (red, 4-hours). The pair broke the 50% Fib retracement level of the downward move from the 1.2169 high to 1.2022 low.

The pair tested the 1.2140 level and the 200 simple moving average (green, 4-hours). The pair is now facing a strong resistance near 76.4% Fib retracement level of the downward move from the 1.2169 high to 1.2022 low.

On the upside, the pair is facing a major resistance near 1.2150. A clear break above the 1.2150 zone could open the doors for a steady increase towards the 1.2200 level.

If there is a fresh decline, the pair is likely to find bids near the 1.2050 zone. There is also a connecting bullish trend line forming with support near 1.2060 on the same chart. A downside break below the trend line support might push the pair towards the 1.2000 support zone.

Overall, EUR/USD could gain momentum if it clears the 1.2150 resistance. Conversely, GBP/USD remains in a strong uptrend and it even broke the 1.4000 resistance.

Economic Releases

- German IFO Business Climate Index Feb 2021 – Forecast 90.5, versus 90.1 previous.

- ECB’s President Lagarde speech.