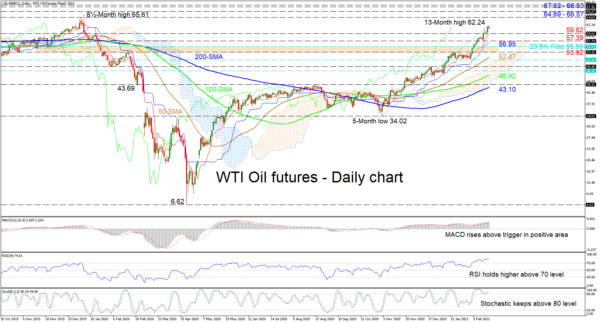

WTI oil futures keep their steady climb, extending above the 60 psychological hurdle. The upward sloping Ichimoku lines are nourishing positive price action, while the climbing simple moving averages (SMAs) are defending the bullish structure.

The short-term oscillators are further validating improvements in the price. The MACD is growing above its red trigger line in the positive region, while the RSI is persisting in overbought territory, not really showing any signs of waning. Furthermore, the stochastic lines are in the overbought zone as well and have bounced off the 80 level, endorsing the current price trajectory.

If buying interest increases, the first tough obstacle buyers may face is the resistance section of 64.69-66.57, which also includes the 8½-month high of 65.61, identified in January 2020. Should the bulls manage to conquer this buffer zone, they may then target another upside limiting band of 67.92-68.53. These two boundaries would need to be overcome for the longer bullish outlook to endure.

Otherwise, if sellers resurface and steer the price down, initial support could come at the 59.62 mark, where the red Tenkan-sen line also resides. Should the pullback gain strength, the 57.39 nearby low and the adjacent blue Kijun-sen line at 56.95 could try to impede a decline from evolving. Nonetheless, if a deeper retracement unfolds, the bears will encounter a vital support zone from the 55.59 barrier until the 53.92 border, the former being the 23.6% Fibonacci retracement of the up leg from 34.02 until 62.24.

Summarizing, oil retains a sturdy bullish demeanour above the 59.62 high. Yet, a dive below the 53.92-55.59 support zone could start to undermine the bullish bias.