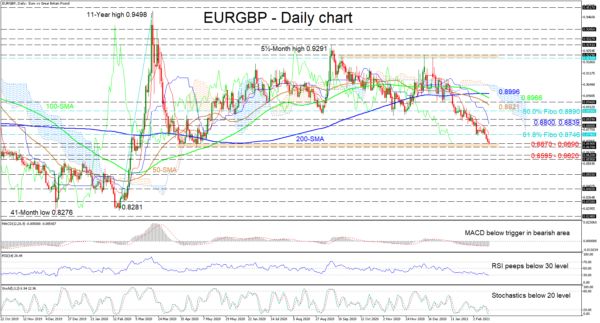

EURGBP is confronting the firm support foundation of 0.8670-0.8690 after deteriorating below the Ichimoku cloud and the simple moving averages (SMAs), more than a month ago. The bearish Ichimoku lines are feeding negative price action, while the falling 50- and 100-day SMAs are nurturing the descent.

Moreover, the short-term oscillators are demonstrating persisting downwards momentum. The MACD, some distance below zero, is slipping under its red trigger line, while the RSI is sliding past the 30 level into oversold regions. Furthermore, the stochastics are in oversold territory and the %K line has yet to give significant signals of fading negative momentum.

To the downside, immediate stern support arises at the 0.8670-0.8690 base. Should the near two-month decline from 0.9210 manage to extend below this severe border, the price may sink to challenge another formidable limiting zone from 0.8620 until 0.8595. Nonetheless, traders need to realise that profound negative moves would be required to overcome these boundaries.

If the pair struggles to extend losses below the base and buying interest picks up, the price may encounter initial resistance at the 0.8746 level, that being the 61.8% Fibonacci retracement of the up leg from 0.8281 until 0.9498. Overstepping the red Tenkan-sen line, the pair could hit the 0.8800 hurdle before meeting the blue Kijun-sen line and the 0.8839 high. If the climb persists, the bulls may then target the 50.0% Fibo of 0.8890.

Summarizing, in order to cement EURGBP’s bearish demeanour, the price would be required to clearly breach the durable 0.8670-0.8690 obstacle. However, a shift back above the 0.8800 mark could fuel more buying interest.