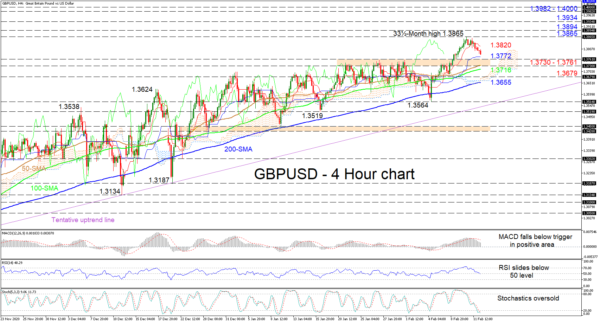

GBPUSD is retreating from its fresh 33½-month high of 1.3865 but the move is looking unconvincing in denting the bullish tone above the tentative trend line, drawn from the 1.2854 low. The red Tenkan-sen line is conveying a drop in upside momentum, while the stalling blue Kijun-sen line is protecting the positively skewed picture. Furthermore, the predominantly bullish simple moving averages (SMAs) appear unintimidated by the withdrawal in the price.

The short-term oscillators are reflecting persisting negative momentum. The MACD, in the positive region, is fading below its red trigger line, while the falling RSI is piercing under the 50 threshold. The stochastic lines are dipping further into oversold territory, endorsing the price pullback.

If the pair continues to retract, downside hindrance could commence from the flattening blue Kijun-sen line at 1.3772 ahead of the vital support section of 1.3730-1.3761. Successfully diving past this hard boundary, which also encompasses the 50-period SMA, sellers, may hit the adjacent 100-period SMA at 1.3716 before targeting the Ichimoku cloud and the 1.3679 trough. From here, should the bears manage to sink under the looming 200-period SMA at 1.3655, this could put pressure on the positive picture turning the focus towards the trend line.

Otherwise, if buyers re-emerge, initial upside limitations may occur at the red Tenkan-sen line at 1.3820 ahead of the multi-year top of 1.3865. Resuming the climb, the bulls could jump towards the 1.3894 and the 1.3934 barriers respectively, from April of 2018. Gaining more ground, the resistance band of 1.3982-1.4000 could prove to be a difficult obstacle to overcome.

Summarizing, GBPUSD’s four months of appreciation look to be impregnable unless the pair produces a more profound retracement below 1.3730 and the SMAs.