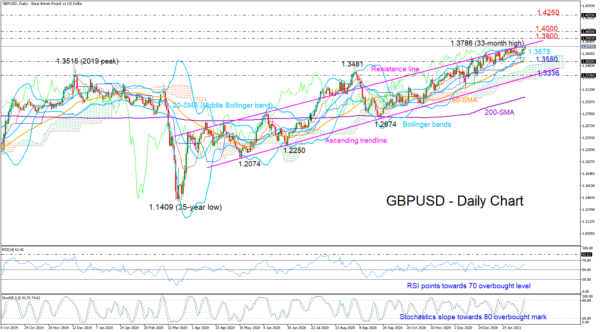

GBPUSD found new buyers near the supportive 20-day simple moving average (SMA), extending its rally to a fresh 33-month high of 1.3786 on Tuesday.

The new peak is again registered near the almost one-year-old resistance line, raising speculation that the price may give up some ground in the short term. The narrowing distance between the Bollinger bands is another sign that the current bullish appetite could change, although the RSI and the Stochastics continue to strengthen towards overbought levels, endorsing the positive appetite in the market.

Nevertheless, any downside reversal may not upset traders unless the base around the 20-day SMA at 1.3675 collapses. In this case, the 50-day SMA could immediately come to the rescue around 1.3550. Should it fail to hold, the sell-off may sharpen towards the lower ascending trendline seen around 1.3336.

In the bullish scenario, if the price crawls above the resistance line, the next obstacle could commence within the 1.3900 – 1.4000 zone, while higher the focus will turn to 1.4250 – a key barrier during the 2016 – 2018 period.

Summarizing, GBPUSD is holding a bullish profile both in the short and medium-term timeframes, though some weakness cannot be excluded as the price is challenging a cautious area.