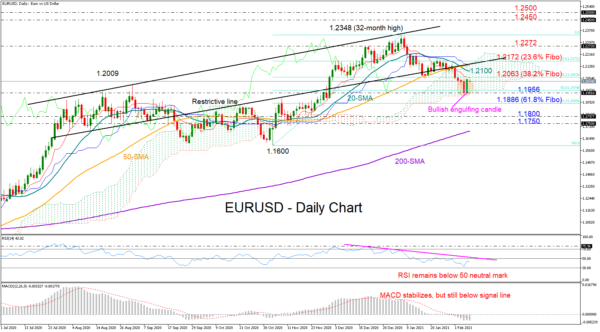

EURUSD bulls dominated on Friday, helping the price to return to the 1.2000 zone after the strong rebound at the bottom of the Ichimoku Cloud, which took the form of a bullish engulfing candle – a signal that the positive momentum may continue in the near term.

Some caution, however, should be warranted as the RSI continues to fluctuate within the bearish territory despite last week’s upside reversal, while the MACD has yet to cross above its red signal line. Trend signals are also discouraging given the lower lows and the lower highs charted below the 1.2348 peak and the recent bearish crossover between the 20- and 50-day simple moving averages (SMAs).

The 38.2% Fibonacci of the 1.1600 – 1.2348 up leg is currently capping the price around 1.2063. If it gives way, it would be interesting to see if the bulls can attract enough buyers to breach the tough 20-day SMA at 1.2100. Such a move would shift all attention to the surface of the cloud at 1.2146, where the restrictive ascending line and the 50-day SMA are placed. Note that the 23.6% Fibonacci is also in the neighborhood around 1.2172, making the region more challenging.

On the downside, a decisive close below 1.1956 could open the door for the 61.8% Fibonacci of 1.1886, simultaneously confirming a neutral outlook in the bigger picture. Lower, the 1.1800 – 1.1750 area could trigger the next selling wave if violated.

Summarizing, EURUSD has found a pivot point at 1.1956, though to eliminate fears of a down-trending market, it may need to crawl back above the ascending trendline and the key resistance region of 1.2172.