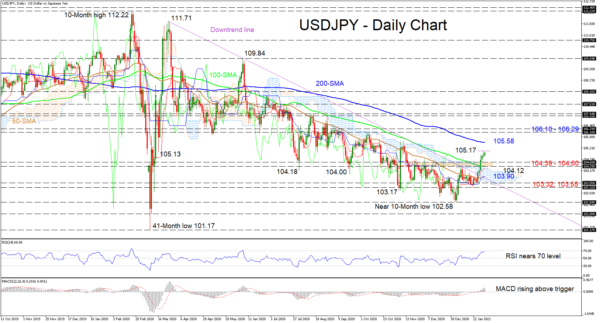

USDJPY is staging impressive gains reaching 105.17 after an initial green candle’s traction from 103.32 morphed into a rally, overcoming the downtrend line drawn from the 111.71 peak, and surpassing the Ichimoku cloud and the 100-day simple moving average (SMA) around 104.39. The bullish Ichimoku lines and the upturn in the 50-day SMA are endorsing the improving sentiment.

The short-term oscillators are also transmitting robust signals in positive momentum. The MACD, in the bullish territory, is strengthening above its red trigger line, while the soaring RSI is approaching the 70 overbought mark.

Maintaining the optimistic edge and stepping above the previous candles high of 105.17, the bulls could propel the price to challenge the heavy 200-day SMA at 105.58, which has secured the downfall in the pair since early July 2020. Should buyers conquer the durable 200-day SMA, the price may accelerate towards the resistance region of 106.10-106.29.

On the flipside, if sellers resurface and drive the pair down, early support could develop from the area of 104.39-104.60, which also contains the 100-day SMA. Steering beneath this obstacle, the cloud’s upper surface at 104.12 and then the 50-day SMA, currently at 103.90, may attempt to dismiss a rekindling of the bigger negative picture. However, the more important test for negative tendencies to grow could be found at the 103.55 and 103.32 lows respectively.

Summarizing, USDJPY maintains an improving tone headed for the 200-day SMA. A break above the 200-day SMA may boost confidence, while a retreat below 103.32 could trigger bearish fears.