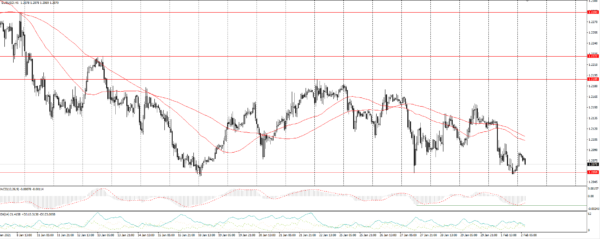

The EUR/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.2130

Prev Close: 1.2059

% chg. over the last day: -0.59%.

The EUR/USD closed Monday trading at the key support level of 1.2059. On the daily chart, there was a consolidation below the SMA50. Other technical indicators are close to zero. The final PMI indices for the Eurozone, which turned out to be higher than in the preliminary calculation, kept the pair from falling further. Although the pair remains under pressure, as the American similar data shows more steady growth.

Trading recommendations

Support levels: 1.2059, 1.1799

Resistance levels: 1.2189, 1.2222, 1.2283

The main scenario for trading the EUR/USD is selling. It is necessary to continue monitoring the 1.2059 level. In case of another rebound, the likelihood of a southern correction will again be called into question. The MACD showed no convergence after Monday’s fall. The ADX showed weak dynamics. The price decline is expected to be slow, and sales will be relevant as long as the pair is below the moving averages.

Alternative scenario: if the price can gain a foothold above the level of 1.2110, the pair may move to an increase to 1.2222.

News feed for 2021.02.02:

- The GDP of Eurozone (q/q) (4q) at 12:00 (GMT+2).

The GBP/USD currency pair

Technical indicators of the currency pair:

Prev Open: 1.3700

Prev Close: 1.3658

% chg. over the last day: -0.31%

The British pound showed a decline against the US dollar by almost half that of the euro. The southern correction of this instrument is still in question. The pair failed to break the key resistance level and Monday’s daily candle showed bearish engulfing with a long shadow at the top. However, the rest of the technical characteristics are still on the side of the bulls.

Trading recommendations

Support levels: 1.3622, 1.3517

Resistance levels: 1.3744, 1.4386

The main scenario for the GBP/USD is trading sideways between 1.3622 and 1.3744. The pair is trading strictly from support to resistance level. Movements within the day remain chaotic. The MACD is giving slight signs of a further decline towards the support level. If the decline occurs without a strong upward pullback, it will lead to convergence, which will serve as a stronger signal for the bears. The ADX is close to zero.

Alternative scenario: if the pair consolidates above the 1.3744 level, it is likely to resume growth to 1.3800. A breakthrough at 1.3622 could trigger a further fall towards 1.3517.

The USD/JPY currency pair

Technical indicators of the currency pair:

Prev Open: 104.77

Prev Close: 104.92

% chg. over the last day: +0.14%

The dollar-yen pair has slowed down a little but remained in a north direction. The indicators on the daily chart show strong bullish potential. The manufacturing sector in the US remains strong, which supports the growth of quotations.

Trading recommendations

Support levels: 104.40, 103.56

Resistance levels: 104.94, 105.68

The main scenario is buying on a decline. The ADX shows a decline in upside potential and the pair has stopped near the October 26 highs. A divergence has been formed on the MACD, which indicates the likelihood of a corrective pullback to 104.48.

An alternative scenario assumes the price-fixing below 104.48 level. In this case, the pair may return to the previous trading range of 104.40 – 103.56.

The USD/CAD currency pair

Technical indicators of the currency pair:

Prev Open: 1.2784

Prev Close: 1.2852

% chg. over the last day: +0.53%

On Monday, the USD/CAD bounced back from all of its Friday losses. At the same time, the oil market continued to grow, which created pressure on the pair. The fundamental background for the pair turns out to be mixed, which indicates the continuation of trading in the sideways range.

Trading recommendations

Support levels: 1.2737, 1.2686

Resistance levels: 1.2875, 1.2932

The main scenario is trading in a sideways range between 1.2805 and 1.2875. A divergence has been formed on the MACD, which signals the likelihood of a correction. This is also indicated by the formed “double top” pattern. But the ADX is at low levels and the price is above the moving averages. The overall signal is neutral.

Alternative scenario: if the price consolidates above 1.2875, the pair may resume its growth. Fixation below 1.2805 will indicate a decline with the first target at the 1.2737 level.