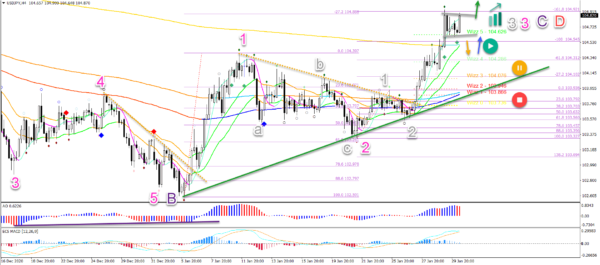

USD/JPY made a strong bullish breakout above the resistance trend line (dotted orange). Therefore, the impulsive bullish price swing is probably a wave 3 pattern.

Price action remains in bullish territory as long as it stays above the 21 ema support zone. A shallow pullback should see a bullish bounce (blue arrow).

A deeper pullback should see the 38.2% Fibonacci level act as support (green arrows). Only a break below the 50% Fibonacci retracement level places the uptrend in danger.

This article reviews the potential space for more upside. We also analyse the key chart and Elliott Wave patterns.

Price Charts and Technical Analysis

The USD/JPY seems to be completing a larger ABC (purple) zigzag within a triangle pattern on the weekly and monthly charts. The current bullish ABC pattern is probably part of a wave D (red).

The recent low completed a wave B (purple) after a divergence pattern appeared (purple).

Now price action is developing in a 3 wave pattern again to the upside.

This is probably a wave 3 (grey) of wave 3 (pink).

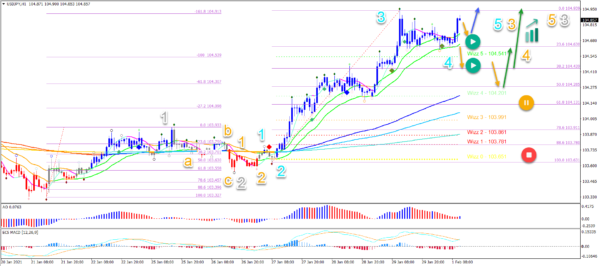

Price action remains in bullish territory as long as it stays above the 21 ema support zone. A shallow pullback should see a bullish bounce (blue arrow). Here are some other variations:

An unexpected break below it puts the uptrend on pauze (yellow circle).

A deep retracement invalidates it (red circle).

An immediate bullish breakout could take place too (green arrow).

On the 1 hour chart, price action seems to be in a wave 4 (light blue) on a lower degree. The price respected the 23.6% Fibonacci level. This means that an immediate bullish continuation (blue arrow) is possible.

A deeper pullback should see the 38.2% Fibonacci level act as support (green arrows). Only a break below the 50% Fibonacci retracement level places the uptrend in danger.

The main targets for upside are at 105, 105.50, 106, and 107.50.