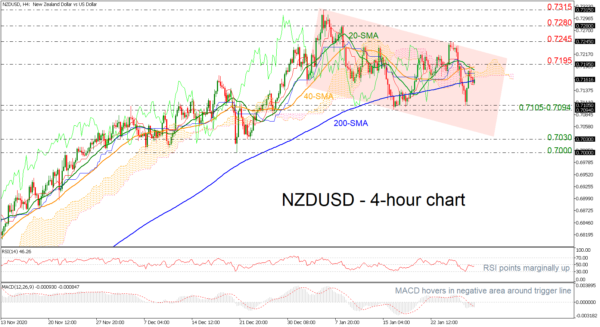

NZDUSD is outperforming over the last three weeks in a descending channel, holding near the 200-period simple moving average (SMA) and beneath the Ichimoku cloud. The RSI is sloping marginally up in the bearish region, while the MACD is trying to surpass the trigger line below the zero level. The 20- and 40-period SMAs created a bearish crossover, pointing to more downside movement.

If the bulls dominate above the 200-period SMA, the spotlight will shift back to the 0.7195 resistance, a break of which could extend the upward move towards the 0.7245 barrier ahead of the 0.7280 barrier. Above that, the door would open for the peak of the channel of 0.7315.

However, a further decline could meet support at the 0.7105-0.7094 area, while a selling interest below the channel could take the pair until 0.7030. Breaking this line, the 0.7000 psychological level could halt bearish actions.

In conclusion, NZDUSD has been in a downside correction, however, a rise above the 0.7315 top could switch the bearish bias back to bullish in the short-term.