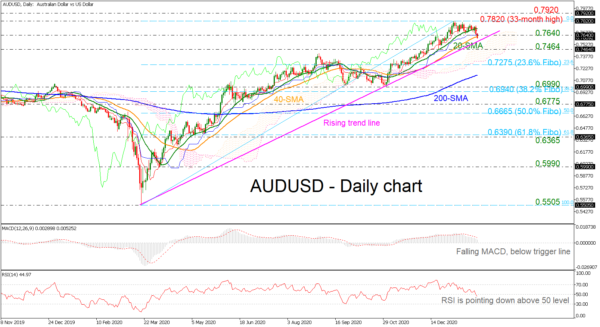

AUDUSD has been creating losses since the day it declined from the 33-month high of 0.7820, unable to remain above the 20- and 40-day simple moving averages (SMAs).

The momentum indicators, though, are currently encouraging an ongoing sell-off in the very short-term. The RSI is falling below the neutral threshold of 50, while the MACD is falling below the zero line in the positive region.

However, a closing price above the 33-month top of 0.7820 could boost buying interest and confirm additional gains towards the 0.7920 barrier, being the high from March 2018. Higher still, the 0.8130 barrier could be the next target which is the resistance identified on January 2018.

In the event of a pullback below the long-term ascending trend line around 0.7575, the bears could push harder to clear the 0.7464 support and the 23.6% Fibonacci retracement level of the upward wave from 0.5505 to 0.7820 at 0.7275. Below that, the 200-day SMA at 0.7136 could come next before slipping to 0.6990.

In brief, AUDUSD seems to be searching for a recovery, though only a closing price above the 33-month high would signal that the slightly descending move has passed.