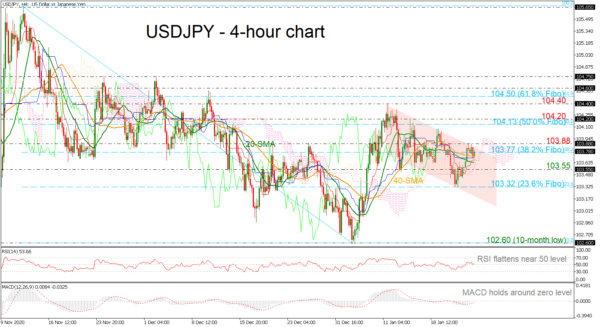

USDJPY is falling further in the short-term and prices continue to drift lower from the 103.88 resistance, finding some support at the 20- and 40-period simple moving averages (SMAs). The short-term technical indicators are pointing to more weakness in the market. The MACD and the RSI are flattening near the zero level and the 50 line respectively.

The next target to the downside is the 103.55 support. At this stage the market would likely see a resumption of the downtrend touching the 23.6% Fibonacci of 103.32 before heading towards the ten-month low of 102.60.

In case of some gains, there is an importance resistance around the 103.88 barrier and the Ichimoku cloud. Rising above this area would help shift the focus to the upside towards the 50.0% Fibonacci retracement level of the down leg from 105.65 to 102.60 at 104.13, followed by the 104.20. More upside moves could lead the market until the 104.40 barrier.

In the short-term, the bearish phase remains in play especially if USDJPY continues to trade within the short-term bearish channel. In the bigger picture, the market has been strongly negative since June 2020.