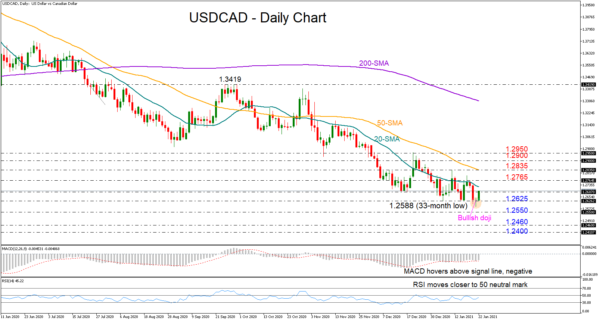

USDCAD stretched its March downtrend to a fresh 33-month low of 1.2588 on Thursday before completing the day with a bullish doji candle.

The positive candle formation is an indication of a coming upside breakout, which the price is currently pushing to confirm, as it is recovering towards its 20-day simple moving average (SMA) at 1.2719.

With the RSI distancing itself above its 30 oversold level and the MACD, although negative, hovering above its red signal line, an upside correction seems to be on the cards. Despite that, traders may wait for a close above the 1.2765 resistance region before raising their buying orders towards the 1.2835 barrier and the 50-day SMA. Higher, the bulls may scope to reverse the downtrend through the 1.2900 – 1.2950 region.

In the case the pair fails to attract enough buyers above the 20-day SMA, it may return to the support of 1.2625, which has been successfully curbing downside movements this month. Should sellers breach that floor, the next stop could be around 1.2550 taken from the cluster of lows registered in April 2018, while lower the 1.2400 – 1.2460 territory could be another “buy the dip” opportunity.

Summarizing, USDCAD is looking to stage its next upside correction after charting new lows, where a close above 1.2675 would likely point to further gains. Otherwise, the bears may need to clear the 1.2625 floor to motivate fresh selling.