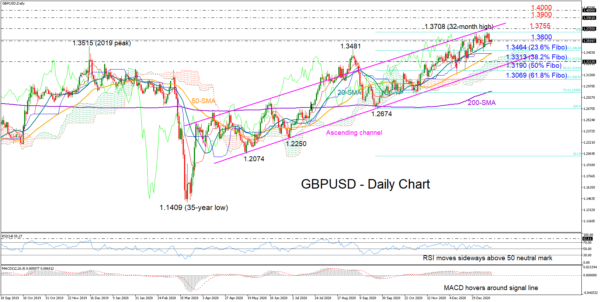

GBPUSD managed to calm bearish forces around the 20-day simple moving average (SMA) once again following the latest rejection from the 1.3700 level, hinting that bullish appetite has not fully faded yet.

In the near-term, the consolidation phase may continue as the RSI and the MACD keep lacking direction, with the former sidelining above its 50 neutral mark and the latter hovering around its red signal line. The red Tenkan-sen also remains trendless above the blue Kijun-sen line, suggesting an indecisive market.

A notable rally above the 1.3700 number, and more importantly beyond the top of the nine-month old ascending channel seen at 1.3755, is what is required to shift the bias on the positive side, bringing the 1.3900 and 1.4000 marks next under the spotlight.

Alternatively, a sustainable move below the 20-day SMA currently at 1.3555 could pause somewhere between the 23.6% Fibonacci of the 1.2674 – 1.3708 upleg at 1.3464 and the supportive 50-day SMA slightly beneath at 1.3422. Should selling pressure persist, the 38.2% Fibonacci of 1.3313 could quickly come to the rescue. If it fails to do so, however, all the attention will shift to the bottom of the channel, where any violation could spark a steeper sell-off. In this case, it would be interesting to see if the 50% Fibonacci of 1.3190 is capable of catching the fall.

In brief, GBPUSD is maintaining a neutral tone in the short-term picture, with traders waiting for a significant close above the 1.3700 top or below 1.3555 to change their exposures accordingly.