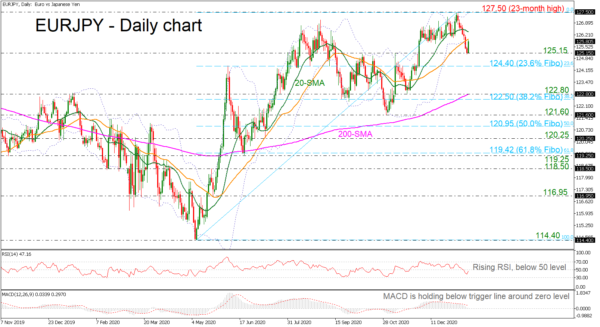

EURJPY tumbled for the seventh day in a row on Monday, recording a seven-week low around the 125.15 support level. However, today, it started the day in the green, recouping some of its losses from the preceding sessions. The upside moves drove the pair near the 40-day simple moving average (SMA) and any advances above this level could repeat the bullish move in the short-term.

Technically, the RSI is returning up with strong momentum, remaining below its neutral threshold of 50, while the MACD oscillator is still losing ground below its trigger line and near the zero level.

In the event of more gains and a jump above the 40-day SMA, the 20-day SMA currently at 126.40 could act as a barrier before being able to re-challenge the 23-month high of 127.50, reached on January 7. Above that, the 129.15 hurdle, taken from the peak on November 2018 could endorse the broader bullish outlook.

A drop below 125.15 should see the 23.6% Fibonacci retracement level of the up leg from 114.40 to 127.50 at 124.40 acting as a major support. A drop below this level would reinforce the bearish structure in the short-term and open the way towards the next key support level of 122.80, where the 200-day SMA is currently converging. Marginally below this line, the 38.2% Fibonacci would come into sight next.

In conclusion, EURJPY is trying to recover some of its recent losses and in the long-term view, the price remains in a bullish tendency.