Key Highlights

- GBP/USD declined below 1.3600, but it found support near 1.3550.

- A possible double top pattern is forming near 1.3700 on the 4-hours chart.

- EUR/USD extended its decline below the 1.2080 support level before correcting higher.

- Gold price is facing an uphill task near $1,860 and $1,880.

GBP/USD Technical Analysis

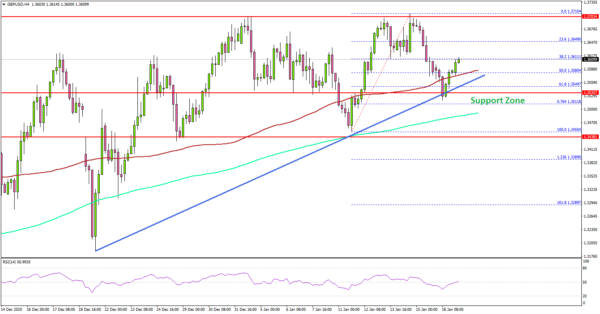

After struggling to clear 1.3700, the British Pound started a fresh decline against the US Dollar. GBP/USD broke the 1.3650 and 1.3600 support levels to start the recent decline.

Looking at the 4-hours chart, the pair seems to be forming a double top pattern near the 1.3700 zone. The recent swing high was formed near 1.3710 before the pair declined steadily.

It traded below the 50% Fib retracement level of the upward move from the 1.3450 low to 1.3710 high. There was a spike below the 1.3550 support, a connecting bullish trend line, and 100 simple moving average (red, 4-hours).

If there is a proper close below the 1.3550 level, the pair could continue to slide towards the 200 simple moving average (green, 4-hours) or even 1.3450. Any more losses may possibly push GBP/USD towards the 1.3280 level.

Conversely, the pair could hold the 1.3550 zone and start a fresh recovery. To break the double top pattern, the pair must surpass the 1.3700 barrier.

Looking at EUR/USD, there were further losses below 1.2080 before it corrected higher. Overall, the US Dollar seems to be gaining ground against majors, but it has a long way to go.

Economic Releases

- German ZEW Business Economic Sentiment Jan 2021 – Forecast 60, versus 55 previous.

- Euro Zone ZEW Business Economic Sentiment Jan 2021 – Forecast 45.5, versus 54.4 previous.