Key Highlights

- EUR/USD declined below 1.2200 and it tested the 1.2065 support zone.

- GBP/USD is eyeing an upside break above 1.3700 and 1.3750.

- Crude oil price is consolidating gains well above $50.00, while gold price is well below $1,880.

- USD/JPY seems to be facing a strong resistance near 104.20 and 104.40.

EUR/USD Technical Analysis

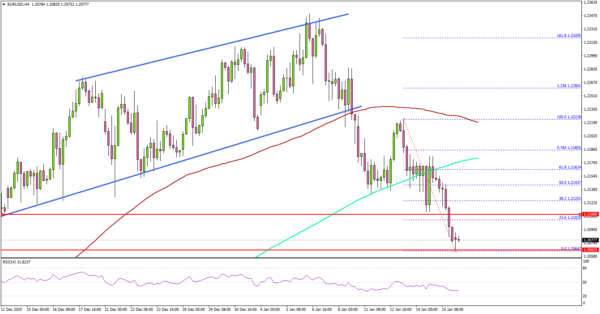

After struggling to clear the 1.2350 level, the Euro started a fresh decline against the US Dollar. EUR/USD broke the 1.2250 and 1.2200 support level to move into a short-term bearish zone.

Looking at the 4-hours chart, the pair broke a couple of important supports near 1.2220 and 1.2200. There was also a break below a major bullish trend line with support near 1.2245 on the same chart.

As a result, there was a sharp decline below the 1.2180 level and the 100 simple moving average (red, 4-hours). The pair traded close to the 1.2065 support level and it even broke the 200 simple moving average (green, 4-hours).

A low is formed near 1.2064 and the pair is currently consolidating losses. The first major resistance on the upside is near 1.2100. The main resistance for a fresh increase is likely forming near 1.2180 and the 200 SMA.

Conversely, the pair might fail to start a fresh increase above 1.2100 and 1.2120. In the stated case, there is a risk of a downside break below the 1.2065 support zone. The next major support is near the 1.2010 and 1.2000 levels.

Overall, EUR/USD must stay above 1.2065 for a fresh increase above 1.2180. Conversely, GBP/USD remained in a positive zone and it seems to be eyeing an upside break above 1.3700 and 1.3750.

Economic Releases

- Eurogroup meetings.