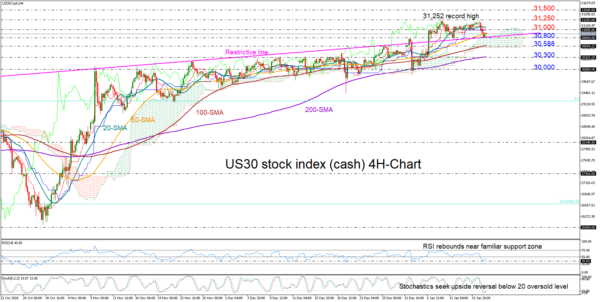

The US 30 index (cash) is nosing around for fresh bullish traction near the four-month old restrictive line at 30,800 after topping twice around its new record high of 32,252.

A clear close below that floor, where the surface of the Ichimoku cloud in the four-hour chart is also placed, would complete a bearish double top formation (more evident in the one-hour chart), likely triggering another negative extension towards the 100-period simple moving average (SMA) and the bottom of the cloud at 30,588. Another step lower may challenge the 200-period SMA at 30,300 before targeting the 30,000 level.

With the RSI, however, attempting to rebound near a familiar support region and the Stochastics set for an upside reversal below the 20 oversold level, buying interest may resurface above 31,000 and hold towards the 32,253 top if the 20-period SMA proves easy to overcome. Should the bullish pressure persist, the index may pin a fresh record high around the 32,500 psychological mark.

In brief, the US 30 index seems to be testing a make-or-break point around 30,800, where a decisive fall below it could motivate fresh selling to 30,588, while a bounce above It may bring the all-time high of 32,253 back under the spotlight.