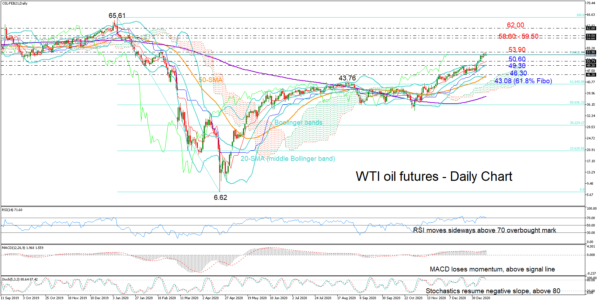

WTI oil futures saw a bit of a drop on Wednesday after touching February’s resistance of 53.90, bringing the 78.6% Fibonacci retracement of the 2020 downfall at 53.00 back under the spotlight.

February’s border could be the key to the next leg of the rally, which may initially pause inside the 58.60 – 59.50 restrictive area before stretching towards the 2019 tops registered within the 62.00 – 65.60 zone.

That said, any improvement might come with some delay as the momentum indicators, although in the bullish territory, have already started to lose strength. The MACD has slowed its pace above its red signal line, while the RSI has been unable to print higher highs above its 70 overbought mark. Likewise, the Stochastics are sloping downwards at a time when the price is flirting with the upper Bollinger band, sending a warning of a potential downside correction or some stabilization in the price.

Immediate support to negative corrections could come from the red Tenkan-sen line at 50.60. However, any bearish extension may not concern traders unless the price crosses below the 20-day simple moving average (middle Bollinger band) currently around the previous high of 49.30. Another drop from here could hit a tougher wall near 46.30, where the 50-day SMA is converging. Deeper, a decisive close below the 61.8% Fibonacci of 43.08 would switch the positive outlook in the medium-term picture to neutral, though such a scenario seems less popular now given the increasing distance between the 50- and 200-day SMAs.

In brief, WTI oil futures are expected to lose momentum in the short run, likely retracing towards 50.60. Otherwise, an exciting rebound above 53.90 may touch the 58.60 – 59.50 area.