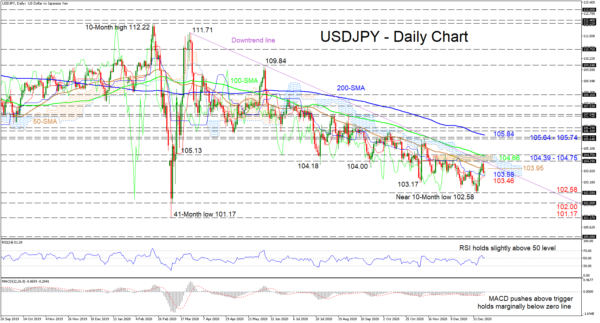

USDJPY seems to be re-adopting its negative tone after being redirected below the 50-day simple moving average (SMA), following the recent deflection off the downtrend line drawn from the 111.71 peak. The flattening Ichimoku lines are suggesting a pause in negative price action, while the controlling SMAs are escorting the pair even lower.

The short-term oscillators currently do not give any compelling signals in directional momentum. The MACD, in the negative region, has thrusted above its red trigger line but has turned horizontal a tad below the zero mark. Yet, the RSI appears to be holding ever so slightly above the 50 threshold.

If sellers manage to guide the price under the immediate Ichimoku lines of 103.58 and 103.46, the pair may target the near 10-month trough of 102.58. Should this bottom give way, the price could slide towards the key 102.00 handle. If selling intensifies further, traders’ full attention may then turn towards the 41-month floor of 101.17.

However, gaining some footing from the Ichimoku lines could see initial resistance come from the 50-day SMA at 103.95. Driving the pair higher, the bulls may encounter significant resistance from the section of 104.39-104.75, which includes the downtrend line, the cloud and the 100-day SMA. Triumphing above this heavy boundary may boost confidence in the pair propelling the price to challenge the 105.64-105.74 limiting band.

Summarizing, USDJPY retains its short-to-medium-term bearish demeanour below the SMAs and the downtrend line. A break below the 102.58 mark could reinforce the negative picture, while a shift above the line and the 104.75 level may fuel further gains.