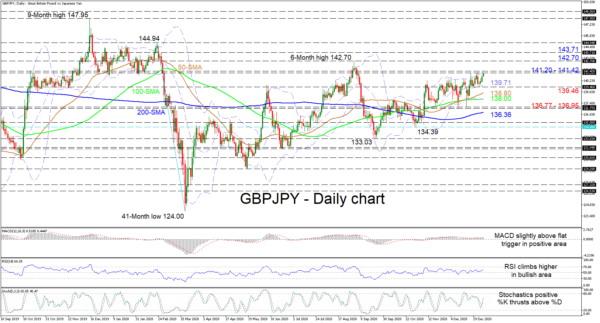

GBPJPY is confronting the resistance belt of 141.20-141.42 after once again finding strong footing off the mid-Bollinger band. The mild inclines in the 100- and 200-day simple moving averages (SMAs) are safeguarding the improving structure, while the upturn in the 50-day SMA is endorsing near-term positive price action.

The short-term oscillators are conveying developments in positive sentiment, backing the upwards creeping tone. The MACD is increasing slightly above its horizontal red trigger line in the positive region, while the RSI is climbing in bullish territory. Furthermore, the positive overlap of the stochastic %D line by the %K line is reflecting the price’s strengthening demeanour.

As things stand, immediate resistance stems from the critical resistance belt of 141.20-141.42. If the bulls manage this time to thrust above the upper Bollinger band encapsulated in this zone, the price could receive the necessary boost to revisit the six-month peak of 142.70. Maintaining a steady hike over this key top, the price could then target the 143.71 significant border.

In a negative scenario, sellers may encounter initial support from the mid-Bollinger band at 139.71 and the neighbouring 139.46 low. Withdrawing below this, a tough zone from the 50-day SMA at 138.80 until the 100-day SMA at 138.00 could attempt to dismiss additional deterioration in the pair. However, should the pair slide further, the bears may turn their focus towards the support band of 136.77-136.95.

Summarizing, in the short-to-medium-term picture, GBPJPY is defending a neutral-to-bullish bias above the SMAs.