Key Highlights

- EUR/USD started a downside correction from the 1.2310 high.

- There was a break below a major bullish trend line at 1.2240 on the 4-hours chart.

- A few important supports on the downside are near 1.2180 and 1.2150.

- The Euro Zone Manufacturing is likely to remain stable at 55.5 in Dec 2020.

EUR/USD Technical Analysis

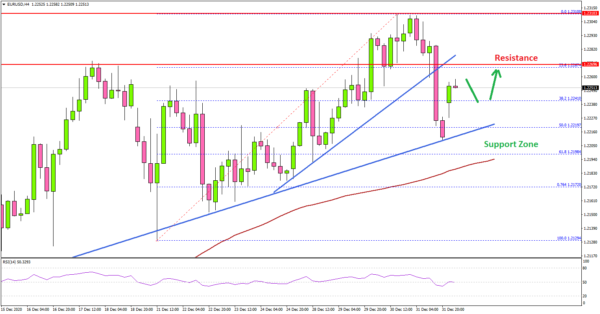

The Euro remained in a positive zone above 1.2200 against the US Dollar. EUR/USD traded to a new multi-month high at 1.2310 before correcting lower.

Looking at the 4-hours chart, the pair corrected lower below 1.2280 and 1.2250 support levels. There was also a break below a major bullish trend line with support at 1.2240.

The bears were able to push the pair below the 50% Fib retracement level of the upward move from the 1.2129 swing low to 1.2310 high. On the downside, the first key support is near the 1.2180 level or the 100 simple moving average (red, 4-hours).

The next major support is near the 1.2150, below which EUR/USD could continue to move down towards the 1.2120 level. Any more losses may possibly call for a test of 1.2080 or the 200 simple moving average (green, 4-hours).

On the upside, the previous support at 1.2250 and 1.2265 could act as a resistance. A close above 1.2265 could open the doors for a test of 1.2310 or even higher in the near term.

Looking at GBP/USD, there was a sharp increase above 1.3550 and the pair even traded above the 1.3650 level. Similarly, gold price is showing positive signs above the $1,880 pivot level.

Economic Releases

- Germany’s Manufacturing PMI for Dec 2020 – Forecast 58.6, versus 58.6 previous.

- Euro Zone Manufacturing PMI for Dec 2020 – Forecast 55.5, versus 55.5 previous.

- UK Manufacturing PMI for Dec 2020 – Forecast 57.3, versus 57.3 previous.

- US Manufacturing PMI for Dec 2020 – Forecast 56.5, versus 56.5 previous.