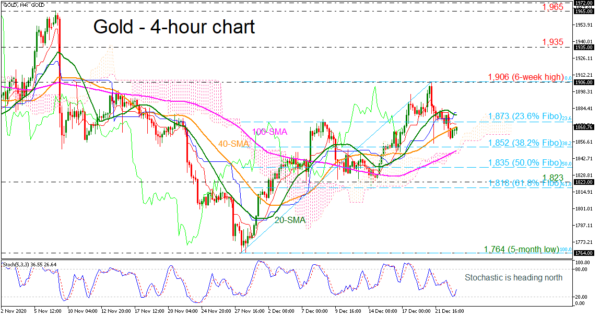

Gold has had a bullish tendency in the short-term, climbing to a new six-week high of 1,906 before it slipped below the simple moving averages (SMAs) and the 23.6% Fibonacci retracement level of the up leg from 1,764 to 1,906 at 1,873.

The %K and %D lines of the stochastic justify the buying pressure in the very short-term, while in trend indicators, 20- and 40-period SMAs are moving towards the current market price to the downside and the 100-period SMA is pointing up, confirming the bigger picture.

A close above the 40-period SMA and the 23.6% Fibonacci will brighten the broader outlook, pushing the price towards the 20-period SMA at 1,878. Beyond that, the rally may gear up to the six-week high of 1,906 ahead of the 1,935 resistance.

Should selling forces strengthen, the 38.2% Fibonacci of 1,852 around the 100-period SMA could initially support to keep the bias on the positive side. Moving lower, the 50.0% Fibonacci at 1,835 could next add some footing ahead of 1,823.

In brief, yellow metal is facing a weakening bullish bias in the very short-term, where a drop below the 100-period SMA currently at 1,848 is expected to enhance selling interest. However, a climb above the six-week high could endorse the upside movement.