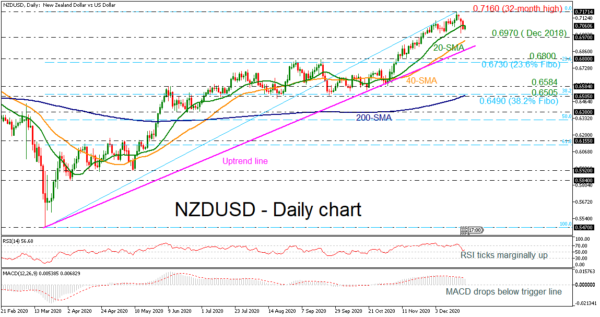

NZDUSD has come under renewed selling pressure, falling below the 20-day simple moving average (SMA) and remaining well below the 32-month high of 0.7160. Despite the latest pullback though, the pair has been in a long-term ascending tendency since March 19. The RSI is plunging from the overbought territory, suggesting a downside correction, while the MACD is holding below its trigger line in the positive region.

In case the selling interest persists, immediate support could come from the 0.6970 support, taken from the high in December 2018. More declines could take the price until the 40-day SMA at 0.6945 ahead of the ascending trend line around 0.6900. A break of the diagonal line could drive the bears towards the 0.6800 psychological mark ahead of the 23.6% Fibonacci retracement level of the upward wave from 0.5470 to 0.7160 at 0.6730. Steeper decreases could flirt with the 0.6584 barrier.

On the flipside, if the bulls retake control, price advances may stall initially near the latest highs at 0.7160, and subsequently near the psychological figure of 0.7200. A potential upside violation of the latter level would also coincide with a continuation of the bullish tendency, sending the market towards the 0.7395 and the 0.7435 resistances, registered on April and February 2018, respectively.

In conclusion, if NZDUSD slips until the ascending line and rebounds then the positive move is still in place. Alternatively, a penetration of the diagonal line could shift the outlook to neutral.