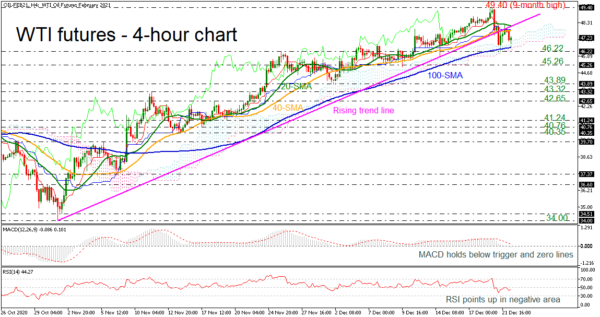

WTI crude oil futures are dropping below the short-term ascending trend line, which had been holding since November 2, finding a powerful support at the 100-period simple moving average (SMA) and the lower surface of the Ichimoku cloud. The MACD oscillator is declining below the zero level with weak momentum, while the RSI is ticking slightly up in the negative territory.

If the price remains beneath the diagonal line and the SMAs, immediate support could come from the 46.22 level, indicating a downside correction. Below that, the 45.26 and the 43.89 supports could come next ahead of 43.32 mark.

On the other hand, an increase above the SMAs could resume the upside tendency, driving the market towards the nine-month high of 49.40. Surpassing this level, the next resistance that bulls could have a look at is the 54.66 barrier, registered on February 20.

Overall, WTI futures seem to be ready for a potential downside retracement if there is a successful sell-off below the 100-period SMA.