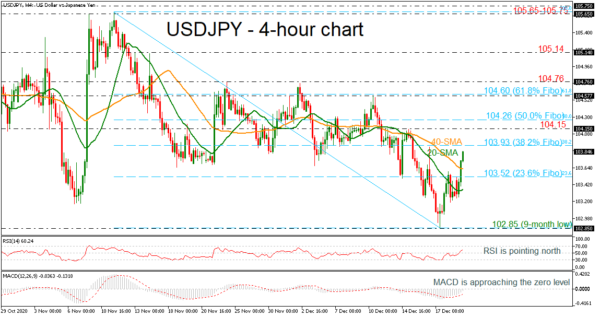

USDJPY found significant support at the nine-month low of 102.85 on Thursday, taking the price above the 20- and 40-period simple moving averages (SMAs). The technical indicators are supporting the latest upside move as the RSI jumped above the 50 level, strengthening its momentum, while the MACD is trying to surpass the zero level.

Immediate resistance could come from the 38.2% Fibonacci retracement level of the downward wave from 105.65 to 102.85 at 103.93. Overcoming this obstacle, the next target is the high of 104.15, registered on December 15 ahead of the 50.0% Fibonacci of 104.26.

If the selling interest persists and the pair reverse lower again, the 40-period SMA at 103.60 could act as a crucial barrier before slipping to the 23.6% Fibonacci of 103.52. Beneath this level, the upward slope of the 20-period SMA at 103.35 could be faced, while a stronger down move could take the market until the nine-month low of 102.85.

Summarizing, USDJPY is ticking higher in the very short-term, however, in the broader outlook the bias is bearish