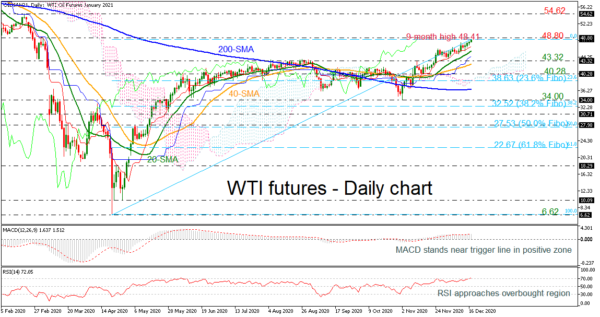

WTI crude oil futures stretched their seven-week rally to a nine-month high of 48.41 earlier today, remaining well above the short-term simple moving averages (SMAs).

The MACD seems to be gaining momentum above its trigger line, the RSI is still hovering around its 70 overbought mark and the red Tenkan-sen is pointing up well above the blue Kijun-sen, all signaling a positive trading in the near term.

Should the bullish bias extend above the nine-month high of 48.41, resistance to upside movements could be initially detected from the 48.80 barrier. Clearing that zone, the next stop could be around the 54.62 resistance, taken from the peak on February 16.

Alternatively, the pair needs to slip below the 20-day SMA to meet a key barrier between the 43.32 support and the 40-day SMA currently at 42.50. The 40.28 mark could act as support too before a more important battle starts near the 23.6% Fibonacci retracement level of the up leg from 6.62 to 48.41 at 38.63.

In the medium-term picture, the sentiment turned bullish after the price surpassed the 43.32 number. The positive slope of the 20- and 40-day SMAs also adds optimism for a brighter outlook.