‘Rising US yields continue to push spreads over gilts towards 2016 lows and will likely drive GBP/USD towards 1.20, if not 1.1850, even though broader range trading is likely to remain.’ – Westpac (based on FXStreet)

Pair’s Outlook

Wednesday was another negative day for the British currency, being that it edged lower against the Buck again. This time the 1.22 threshold has been crossed, meaning the Cable is one step closer to reaching the 1.1947 level—the lowest in more than ten years. Even though the lower Bollinger band and the monthly S2 now represent immediate support around 1.2130, this area is unlikely to hold the GBP/USD pair afloat for long, namely it is expected to remain intact only today. Meanwhile, technical indicators remain unchanged, with the weekly signals still bearish.

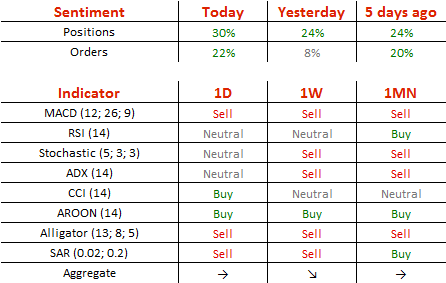

Traders’ Sentiment

Traders keep getting more bullish towards the Sterling, as now 65% of all open positions are long, compared to 61% on Monday. The portion of buy orders is also relatively large, taking up 61% of the market.