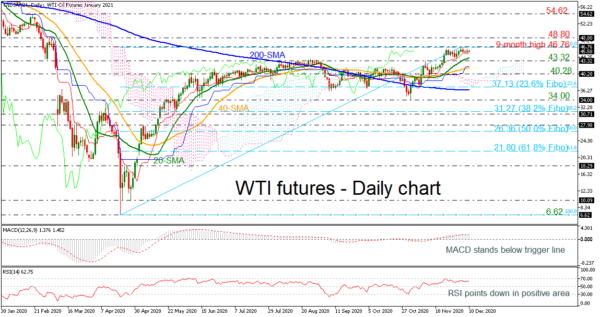

WTI futures recorded a rally last week towards a nine-month high of 46.76, though, the price is on the backfoot this week and the technical indicators suggest that the market could ease a little bit in the short-term.

The RSI is currently increasing negative momentum towards its neutral threshold of 50 after a decline from overbought levels, while the MACD is slowing down in positive territory. Both are hinting that the next move in prices could be on the downside rather than on the upside.

Should the market extend losses, support could be met between the 20-day simple moving average (SMA) at 44.23 and the 43.32 barrier. A leg below this area could send prices towards the 40-day SMA at 41.74 before challenging the 40.28 level. Then, if the market fails to hold above this level, the next stop could be at the 23.6% Fibonacci retracement level of the up leg from 6.62 to 46.76 at 37.13, near the 200-day SMA.

On the flip side, if oil advances above the nine-month peak of 46.76, immediate resistance could be met at the 48.80 line. Steeper increases, though, could drive the commodity north towards the 54.62 resistance, registered on February 20.

In the bigger picture, WTI crude oil futures is bullish as long as it holds above the 200-day SMA. In case it violates this line, bears could take the upper hand.